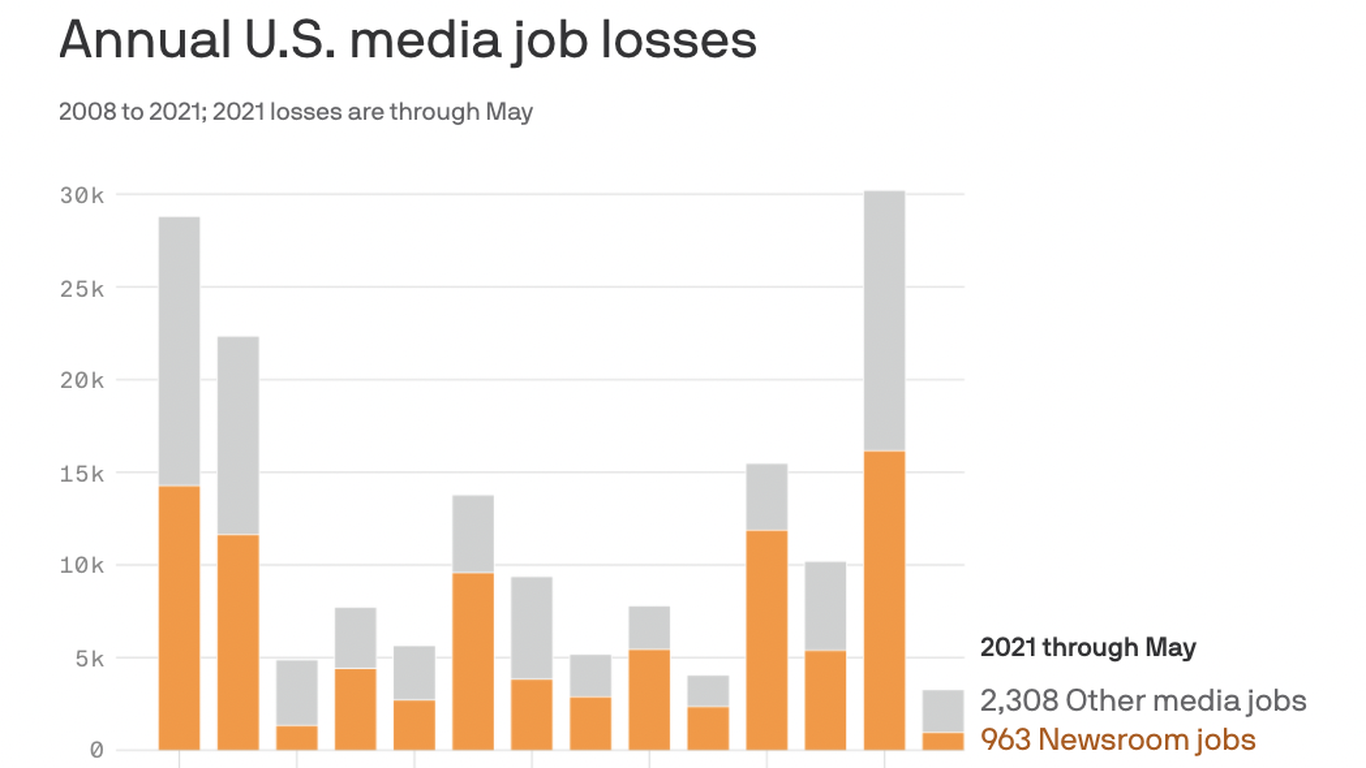

About 963 newsroom jobs have been lost so far this year – down 91% from the 10,576 layoffs in the same period last year, new data shows.

The big picture: Other factors, like the record growth in advertising and the rapid return of live events, suggest that the media industry is rebounding faster than it initially expected.

Why is this important: A year ago, media companies were reeling from the first effects of COVID-19 – rushing for loans and laying off thousands of people while hoping to weather a possible recession.

- Now things are looking up, mainly because the economy has not collapsed.

Driving the news: New data from Challenger, Gray & Christmas, Inc. suggests that while many media jobs are still being lost, hundreds are starting to be added.

- So far this year, media employers have announced 725 new hiring plans, up from just 12 at the same time last year.

Advertising is exploding. Global ad spending is expected to increase from $ 78 billion in 2021 to an all-time high of $ 657 billion, according to a new mid-year forecast from advertising firm Magna.

- This follows a 2.5% drop in 2020, which prompted dozens of media outlets to implement massive layoffs and pay cuts last spring.

- Today, many publishers report that their advertising revenue have completely rebounded or even increased as a result of the tumultuous turn of events of the past year.

- Looking ahead, the US advertising market is expected to grow by $ 34 billion to $ 259 billion this year, its highest growth rate in 40 years.

Be smart: The adoption of new digital products, such as virtual events, e-commerce, and online courses, has also prompted media companies and newsrooms to diversify their revenues, and for some, earn even more money than before.

Yes, but: There are still a few setbacks that will impact the industry this year, especially at the local level.

- Donald Trump’s exit ex officio means that subscription revenues for many publications are not growing as quickly as they were last year. According to data from SimilarWeb, traffic to news sites is generally down.

- Local newspapers continue to face headwinds as private investment firms seek to consolidate local securities even further after the pandemic.

- Even though the PSPC (Special Purpose Acquisition Companies) are seen as strong investment vehicles for many media companies, concerns over the cooling of the PSPC market mean that not all companies will be able to raise the funds needed to enter on the stock market via a blank check company.

At the end of the line : The anticipated collapse of the economy prompted media companies to take drastic measures in the first half of last year to avoid sinking. A year later, the media industry is largely on the mend.